This is the tenth installment of the On Professionalism thread series.

The previous installment thread can be found here:

Decision Tree Trade Management

The index and first installment can be found here:

On Professionalism

Points, not dollars:

One change you can make to help with cutting losses is to remove the dollar signs from your view as you trade. Stop looking at your account's profit and loss (P/L's,) for it can easily turn into a bad influence.

Your time as a trader is to be spent living in the moment, in the current trade, that's it. And besides, your past trade's impact on your profit and loss statement should have zero impact on your next trade's decision or risk.

As a trader, you will be aiming to make pips/ticks/points/pennies**, not a dollar return. The idea here is to remove the ability of your current P/L from the decision process on your next trade (...how many times have you put on 'just one more trade' to help recover from losses when you didn't really have a clear signal?)

**Pennies is in the stock trading world, where the tightest price difference between price points is often measured as a penny or fraction of a penny.

If your trading platform has an option to change how profit and loss is displayed, at least in your active blotter (active orders and open positions) window while you're trading, then set it accordingly.

You can always review your hard P/L at the day's end or once a week to see things in money terms.

The Positive Mental Framing of Non-Monetary Goals.

Humans love positive feedback. Positive feedback lets us know we're doing something right.

Unfortunately though, our mind can work against us when it comes to setting trading related goals thanks to our positive future bias and need break goals down to smaller and easily obtainable chunks.

The logical and analytical side of our psyche will lead us to breaking down any large goal into smaller steps. Though this, we gain a sense of accomplishment as progress is made, and we play to our desire for instant gratification. If this thought doesn't come naturally to us, we've probably learned to do it from one of many bits of advice on time management picked up while we were attending school or at work. (Any project management course/book/etc.. would have beat this process of breaking larger tasks down into many smaller tasks into our heads many times over.)

So if you're like the average trader out there, you've probably set a fractional goal on a daily or weekly bases that gives you something to work toward (ie, 10% per month, or 10 pips per day, or 100 pips per week, etc.)

We're probably all guilty of it at some point, and I know even I'm guilty of making this mistake back when I first started trading. (I set up spreadsheets to do profit projections based of limited data and out of touch expectations.) "If I could only make 5% a day I'd be a zillionare in no time!"

So if you've done this, worry not because you're normal, but what do I say about normal in the markets?

Normal doesn't work!

By setting monetary goals you're really just giving yourself additional pressure and priming your mind to give in to all the "normal" human tendencies that will cause traders to have severely reduced returns or even fail in the long run.

For example:

Let's say you have a 10 pip per day goal.

You feel that with all the market action in a given day, with currency pairs moving hundreds of pips each, you could capture 10 pips of net profit per day easily. To achieve this, you've created a system that waits for a specific signal before entering a trade.

One day, you don't get a clean signal all day long. You're frustrated because the market isn't acting in a way your system can work from. You're worried you won't make your goal, so you take a not-so-clear signal that's not quite within your system but you feel it's close enough to justify the risk.

Or, worse yet, you did have a good signal, but it was a loser, and now your brain is in revenge mode where you're looking for any cruddy signal possible to take so you can make back the loss and grab your net of 10 pips in the process.

The monetary goal has then become a negative psychological influence, despite you creating it with all the best intentions.

Even if the not-so-clean signal or the revenge trade work out, you've violated your own risk tolerance within your system and shifted the statistical expected outcome against you. Over time, you'll have trades taken like this that don't work and the losses will sting on an emotional level (since they weren't within your plan and you weren't truly prepared to deal with them) as well as sting your equity curve.

In the case of the revenge trade, this might even compound and you'll end up taking yet another crappy signal just to make back the two losses and get ahead (or just break even.) The cycle would continue till you snap out of it and realize your losses for the day, or finally reach your goal of 10 pips despite risking many times more than your acceptable risk limit to get there (negative expectancy trading,) or bust out your account all over a failed 10 pip trade.

That right there has to be the worst feeling as a trader, not the loss, but realizing you blew an account through emotional trading over a small 10 pip initial trade target.

Now, goals are still an important part of trading, and I don't want to give the impression all goals are bad in general. What matters is setting the right kind of goal that will actually help you with consistency and discipline, and framing the goal in a way that works to overcome our natural tendencies which can hold us back from becoming professional traders.

Enter: The NON-Monetary Goal.

Here we're going to take the idea of removing $-signs from our view to the next level by removing them from our longer term planning and shorter term goals as well.

Let's say you are trying to be a career trader: Instead of thinking "I want to make $100k USD a year trading," let's approach this from what you truly want... "I want financial independence."

Notice how there's no mention of trading in there? You want to be financially independent, that can happen through trading, but it can also happen though sitting on your hands during times that your trading style will only hurt you (different types of markets.) Being "flat" is just as valid of a position as being long or short after all.

Removing the yearly income goal also removes the pressure to perform each month. The best trader I know at my firm will happily sit on his hands or trade with next to no size for nearly a year without feeling pressured. If he doesn't have an edge (that is, if his systems aren't good for the current type of market) he doesn't risk, it's that simple for him.

When his type of trading becomes in favor, BAM, the guy can turn out a years worth of an average person's income in just a few days or months. His goal is to be financially independent, not make a specific dollar amount each year, and that allows him to be happy to sit all day long watching the markets for months at a time not doing anything of significance with his capital because risking outside of his edge/plan simply violates his goal of being financially independent.

Now, if we've cut away the tangible $-sign from our longer term goal, how do we break it down into smaller, easy to achieve, goals that we can aim for on a daily or weekly basis? We still want that short term gratification after all and it can be a really good thing to get positive feedback day-to-day as you trade (so long as it's framed correctly.)

So let's take the longer term goal of being "financially independent" and see what components of said goal can be extracted: Well, someone who's financially independent sure isn't letting the market have its way with their capital, so they've probably set strict stops and don't leave themselves exposed to greater losses by trading without stops or doing silly things like doubling down, averaging losers, or over-leveraging... so we got the basis of a few short term goals right there.

After each day, go over this list (or the list you created of non-monetary goals) and do something positive if you can check each line item off. Reward yourself. Watch a movie you wanted to see, or maybe get a glass of wine/beer/etc to celebrate.

This direct reward system is going to combine with one thing that will really give you some gratification, your equity curve. If you're in a drawdown, it will help limit the impact of the bad trades. And, if you're doing well, your equity curve will start to smooth right out and look like a steady gradual increase.

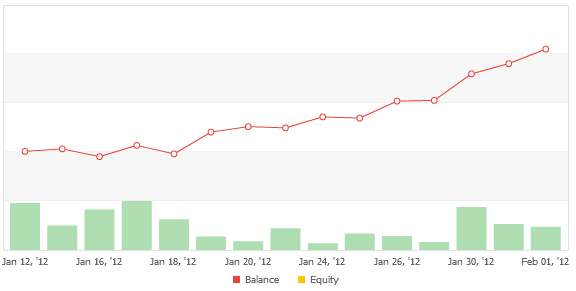

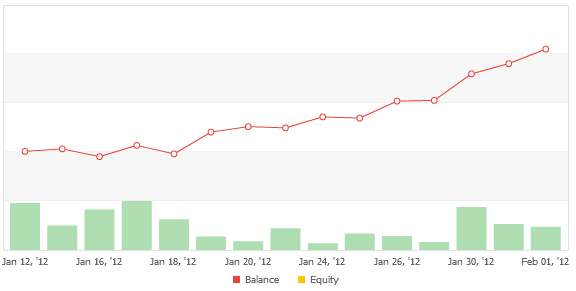

You want a result that looks like this:

(BTW, this is a logarithmic balance by $ growth chart example, NOT an equity by % growth chart which would have a much higher incline on the curve and look more impressive. The point is to show consistent gains without a wide variation as it relates to the subject. Notice losing days are shallow? Notice gaining days are consistent?)

This is the exact gratification, in the right frame of mind, that's sustainable and contributes to becoming financially independent.

You will feel good not only for rewarding yourself and following your rules/goals, but you'll have an equity curve that gives you direct feedback of doing well.

Most new trader's equity curves are like mountain peaks, jagged and volatile, you can't truly tell how well you're doing if you're just 2-3 days away from dropping 40% of your account. Worse yet, how will your equity curve ever tell you something's wrong with your system if by the time you realize it your account is only 1/3rd of its former value?

We can build on this, and extend the goals over a weekly basis:

If you can check these off (or any other weekly non-monetary goals you've written for yourself) at the end of the week, reward yourself. It can be anything, like your favorite chocolate bar that you always feel guilty eating since you're trying to cut out sweets.. but do something to reward yourself. You've earned it!

Don't punish yourself if you didn't meet these objectives (remember the installment about positive self dialogue,) keep it positive, and reward yourself when it's deserved:

Lastly, refrain from doing the same things you would to reward yourself in order to make yourself feel better after a bad day. This would be like hitting the bars after a bad day or pigging out on your favorite--yet unhealthy--food for comfort. You want to avoid such actions to smooth over bad moods as they generally only build up into a dependence on such things (using alcohol as a crutch can later turn into alcoholism for example.)

If you did violate such rules, refer back to the exercise and mediation installation from earlier, and start to focus in on what's preventing you from achieving a good week where you follow all the rules you set out.

I'm not telling you to punish yourself after a bad day or do something negative, you can still be positive and do positive things (exercise, seriously this helps on bad days a lot, and if you're the worst trader in the world at least you'll be really fit and healthy,) but don't reward yourself with treats/drinks/etc if you want to associate said rewards with positive performance.

This might sound restrictive, but think of training your unconscious mind like training an animal; if you feed your pet treats after it "makes a mess" on your expensive rug, as well as treat your pet for doing a trick or behaves well, your pet will not stop making messes on your rug.

(If you're a social drinker for instance, then it might be a good idea to use something else than a glass of wine or beer as a reward, since you'll be in environments that include drinking if you've met your goals or not. Maybe have a pizza night at the end of the week? Go on a nature hike? Break out the fuzzy pink hand-cuffs with your significant other? Be creative here, you're going to know what best rewards yourself and what you think would be a good fit.)

The next installment in the On Professionalism thread series can be found here:

Never Take Advice From Friendly Strangers and Series Conclusion

The previous installment thread can be found here:

Decision Tree Trade Management

The index and first installment can be found here:

On Professionalism

Points, not dollars:

One change you can make to help with cutting losses is to remove the dollar signs from your view as you trade. Stop looking at your account's profit and loss (P/L's,) for it can easily turn into a bad influence.

Your time as a trader is to be spent living in the moment, in the current trade, that's it. And besides, your past trade's impact on your profit and loss statement should have zero impact on your next trade's decision or risk.

As a trader, you will be aiming to make pips/ticks/points/pennies**, not a dollar return. The idea here is to remove the ability of your current P/L from the decision process on your next trade (...how many times have you put on 'just one more trade' to help recover from losses when you didn't really have a clear signal?)

**Pennies is in the stock trading world, where the tightest price difference between price points is often measured as a penny or fraction of a penny.

If your trading platform has an option to change how profit and loss is displayed, at least in your active blotter (active orders and open positions) window while you're trading, then set it accordingly.

You can always review your hard P/L at the day's end or once a week to see things in money terms.

The Positive Mental Framing of Non-Monetary Goals.

Humans love positive feedback. Positive feedback lets us know we're doing something right.

Unfortunately though, our mind can work against us when it comes to setting trading related goals thanks to our positive future bias and need break goals down to smaller and easily obtainable chunks.

The logical and analytical side of our psyche will lead us to breaking down any large goal into smaller steps. Though this, we gain a sense of accomplishment as progress is made, and we play to our desire for instant gratification. If this thought doesn't come naturally to us, we've probably learned to do it from one of many bits of advice on time management picked up while we were attending school or at work. (Any project management course/book/etc.. would have beat this process of breaking larger tasks down into many smaller tasks into our heads many times over.)

So if you're like the average trader out there, you've probably set a fractional goal on a daily or weekly bases that gives you something to work toward (ie, 10% per month, or 10 pips per day, or 100 pips per week, etc.)

We're probably all guilty of it at some point, and I know even I'm guilty of making this mistake back when I first started trading. (I set up spreadsheets to do profit projections based of limited data and out of touch expectations.) "If I could only make 5% a day I'd be a zillionare in no time!"

So if you've done this, worry not because you're normal, but what do I say about normal in the markets?

Normal doesn't work!

By setting monetary goals you're really just giving yourself additional pressure and priming your mind to give in to all the "normal" human tendencies that will cause traders to have severely reduced returns or even fail in the long run.

For example:

Let's say you have a 10 pip per day goal.

You feel that with all the market action in a given day, with currency pairs moving hundreds of pips each, you could capture 10 pips of net profit per day easily. To achieve this, you've created a system that waits for a specific signal before entering a trade.

One day, you don't get a clean signal all day long. You're frustrated because the market isn't acting in a way your system can work from. You're worried you won't make your goal, so you take a not-so-clear signal that's not quite within your system but you feel it's close enough to justify the risk.

Or, worse yet, you did have a good signal, but it was a loser, and now your brain is in revenge mode where you're looking for any cruddy signal possible to take so you can make back the loss and grab your net of 10 pips in the process.

The monetary goal has then become a negative psychological influence, despite you creating it with all the best intentions.

Even if the not-so-clean signal or the revenge trade work out, you've violated your own risk tolerance within your system and shifted the statistical expected outcome against you. Over time, you'll have trades taken like this that don't work and the losses will sting on an emotional level (since they weren't within your plan and you weren't truly prepared to deal with them) as well as sting your equity curve.

In the case of the revenge trade, this might even compound and you'll end up taking yet another crappy signal just to make back the two losses and get ahead (or just break even.) The cycle would continue till you snap out of it and realize your losses for the day, or finally reach your goal of 10 pips despite risking many times more than your acceptable risk limit to get there (negative expectancy trading,) or bust out your account all over a failed 10 pip trade.

That right there has to be the worst feeling as a trader, not the loss, but realizing you blew an account through emotional trading over a small 10 pip initial trade target.

Now, goals are still an important part of trading, and I don't want to give the impression all goals are bad in general. What matters is setting the right kind of goal that will actually help you with consistency and discipline, and framing the goal in a way that works to overcome our natural tendencies which can hold us back from becoming professional traders.

Enter: The NON-Monetary Goal.

Here we're going to take the idea of removing $-signs from our view to the next level by removing them from our longer term planning and shorter term goals as well.

Let's say you are trying to be a career trader: Instead of thinking "I want to make $100k USD a year trading," let's approach this from what you truly want... "I want financial independence."

Notice how there's no mention of trading in there? You want to be financially independent, that can happen through trading, but it can also happen though sitting on your hands during times that your trading style will only hurt you (different types of markets.) Being "flat" is just as valid of a position as being long or short after all.

Removing the yearly income goal also removes the pressure to perform each month. The best trader I know at my firm will happily sit on his hands or trade with next to no size for nearly a year without feeling pressured. If he doesn't have an edge (that is, if his systems aren't good for the current type of market) he doesn't risk, it's that simple for him.

When his type of trading becomes in favor, BAM, the guy can turn out a years worth of an average person's income in just a few days or months. His goal is to be financially independent, not make a specific dollar amount each year, and that allows him to be happy to sit all day long watching the markets for months at a time not doing anything of significance with his capital because risking outside of his edge/plan simply violates his goal of being financially independent.

Now, if we've cut away the tangible $-sign from our longer term goal, how do we break it down into smaller, easy to achieve, goals that we can aim for on a daily or weekly basis? We still want that short term gratification after all and it can be a really good thing to get positive feedback day-to-day as you trade (so long as it's framed correctly.)

So let's take the longer term goal of being "financially independent" and see what components of said goal can be extracted: Well, someone who's financially independent sure isn't letting the market have its way with their capital, so they've probably set strict stops and don't leave themselves exposed to greater losses by trading without stops or doing silly things like doubling down, averaging losers, or over-leveraging... so we got the basis of a few short term goals right there.

- I didn't put my capital at risk beyond what's acceptable in my trade plan today.

- I didn't lose more than x% on my bad trades today. And I didn't lose more than x% of my total capital should it have been a bad day. (Sub x for your acceptable risk, I suggest 0.5%-1% for individual trades and 4% for the daily max.)

- I didn't over-leverage today.

- I didn't revenge trade today, or if I did, I quickly identified it and took myself out of the market. I did NOT let it stand to see what happens.

- I didn't over-trade today.

After each day, go over this list (or the list you created of non-monetary goals) and do something positive if you can check each line item off. Reward yourself. Watch a movie you wanted to see, or maybe get a glass of wine/beer/etc to celebrate.

This direct reward system is going to combine with one thing that will really give you some gratification, your equity curve. If you're in a drawdown, it will help limit the impact of the bad trades. And, if you're doing well, your equity curve will start to smooth right out and look like a steady gradual increase.

You want a result that looks like this:

(BTW, this is a logarithmic balance by $ growth chart example, NOT an equity by % growth chart which would have a much higher incline on the curve and look more impressive. The point is to show consistent gains without a wide variation as it relates to the subject. Notice losing days are shallow? Notice gaining days are consistent?)

This is the exact gratification, in the right frame of mind, that's sustainable and contributes to becoming financially independent.

You will feel good not only for rewarding yourself and following your rules/goals, but you'll have an equity curve that gives you direct feedback of doing well.

Most new trader's equity curves are like mountain peaks, jagged and volatile, you can't truly tell how well you're doing if you're just 2-3 days away from dropping 40% of your account. Worse yet, how will your equity curve ever tell you something's wrong with your system if by the time you realize it your account is only 1/3rd of its former value?

We can build on this, and extend the goals over a weekly basis:

- I executed over 90% of my trades this week without violating my risk rules (remember, we're human and mistakes happen, don't punish yourself twice for making a mistake, but do correct the mistake instantly when you realize you've made it.) (NOTE: the % should change depending on how many trades your system does per week, so for a scalper who trades 10-30 times a day like myself, my percentage is 98%... but if you only trade 10 times a week on average then 9/10 is a good goal so 90% would due.)

- My drawdown periods over multiple days (it happens to even the best traders) were limited and in line with my acceptable risk.

- When the market wasn't going to work for my system, I didn't trade.

If you can check these off (or any other weekly non-monetary goals you've written for yourself) at the end of the week, reward yourself. It can be anything, like your favorite chocolate bar that you always feel guilty eating since you're trying to cut out sweets.. but do something to reward yourself. You've earned it!

Don't punish yourself if you didn't meet these objectives (remember the installment about positive self dialogue,) keep it positive, and reward yourself when it's deserved:

Lastly, refrain from doing the same things you would to reward yourself in order to make yourself feel better after a bad day. This would be like hitting the bars after a bad day or pigging out on your favorite--yet unhealthy--food for comfort. You want to avoid such actions to smooth over bad moods as they generally only build up into a dependence on such things (using alcohol as a crutch can later turn into alcoholism for example.)

If you did violate such rules, refer back to the exercise and mediation installation from earlier, and start to focus in on what's preventing you from achieving a good week where you follow all the rules you set out.

I'm not telling you to punish yourself after a bad day or do something negative, you can still be positive and do positive things (exercise, seriously this helps on bad days a lot, and if you're the worst trader in the world at least you'll be really fit and healthy,) but don't reward yourself with treats/drinks/etc if you want to associate said rewards with positive performance.

This might sound restrictive, but think of training your unconscious mind like training an animal; if you feed your pet treats after it "makes a mess" on your expensive rug, as well as treat your pet for doing a trick or behaves well, your pet will not stop making messes on your rug.

(If you're a social drinker for instance, then it might be a good idea to use something else than a glass of wine or beer as a reward, since you'll be in environments that include drinking if you've met your goals or not. Maybe have a pizza night at the end of the week? Go on a nature hike? Break out the fuzzy pink hand-cuffs with your significant other? Be creative here, you're going to know what best rewards yourself and what you think would be a good fit.)

The next installment in the On Professionalism thread series can be found here:

Never Take Advice From Friendly Strangers and Series Conclusion