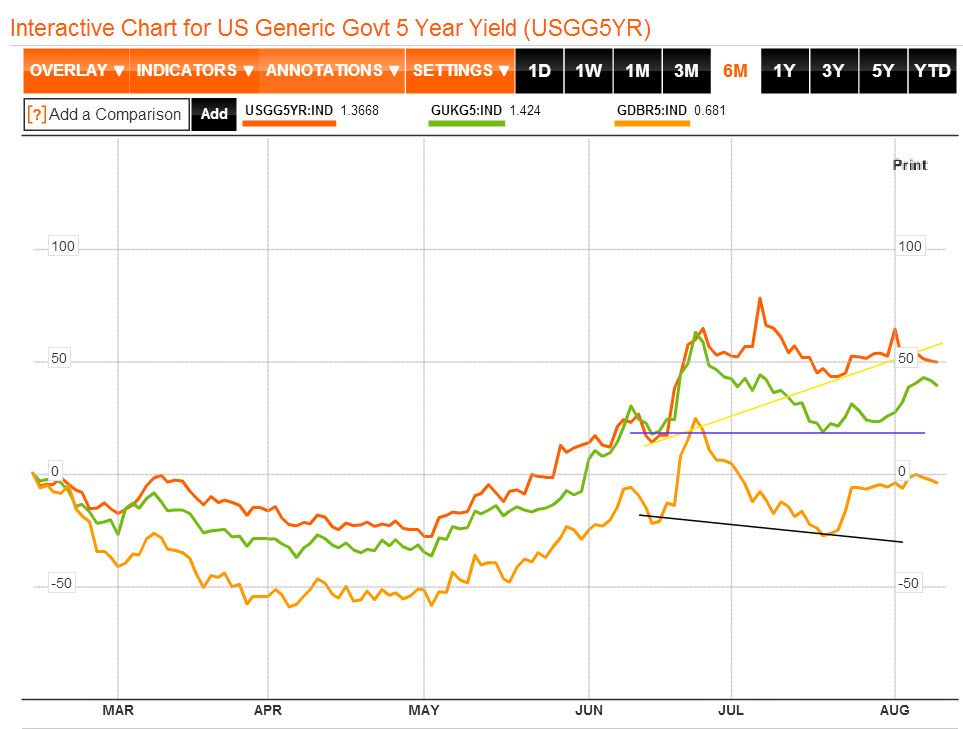

For charting the change in value between bonds themselves, Tansen already linked a decent source on charting:

Tansen said:

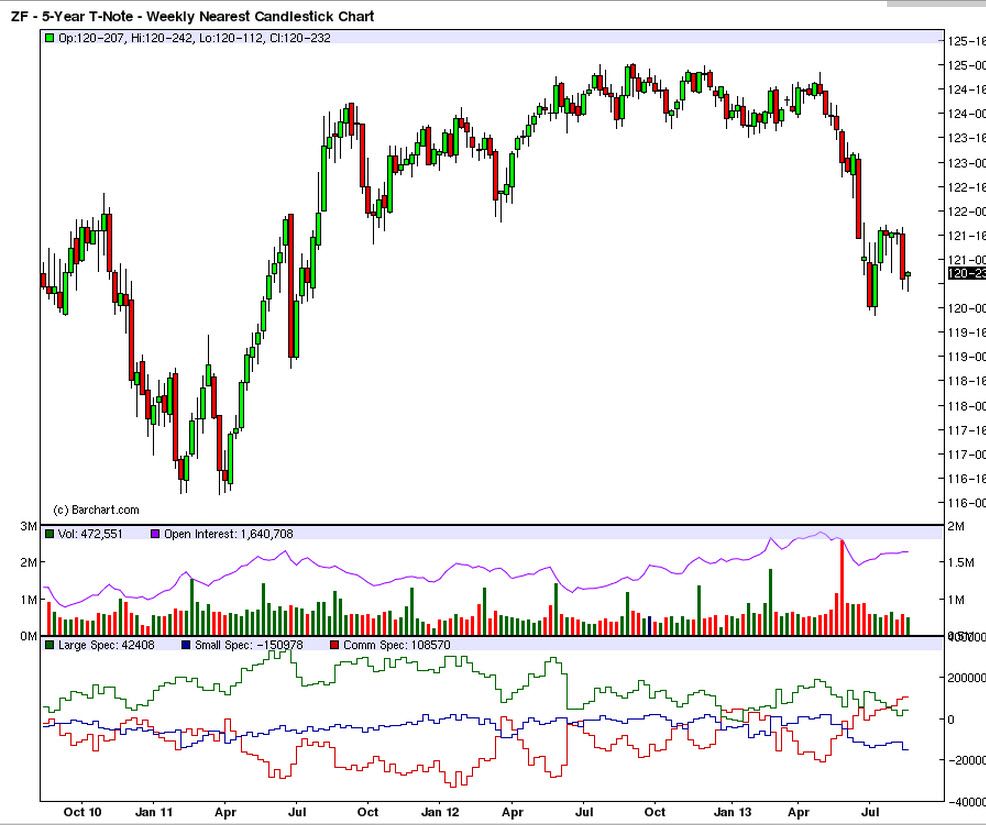

This is, of course, a long term sentiment you'll be following with these charts. You can not expect to scalp with this info, but it can tell you when you'll want to pay attention to moves in the dollar index or dollar based pairs.

The connection between the dollar's value and bonds is at a fundamental level:

In order for people to buy US bonds, they need US dollars. In order for people to buy Euro/German/French/etc.. bonds, they need Euros. Capital will flow around the world naturally to where it can be employed and gain the greatest yield/return relative to the risk involved. If people expect higher yields will be found State-side, then capital will flow into the US dollars from Euros (and elsewhere) in the staging process of being employed in the US to gain some returns.

This is why base central bank interest rates matter so much to forex pairs. This is why rate decisions can be one of the most sharp price moves found when comparing volatility around news releases. When a country raises their rates, capital is attracted to them (assuming inflation is tame enough, as I said, all relative to risk) and their currency tends to appreciate.

So, as a proxy to this sentiment (of capital flowing into and out of a given currency thanks to the improving or diminishing economy,) we can watch bond rates/yields in the US and the dollar index (DX contracts) and gain a sense of what's going on and what biases we should have going into longer term FX trades.

To be clear, there's going to be a million other reasons why yields and bond rates change, but should money be flowing into or out of USD, we know other currencies must be spent or bought in order to do this, and thus we have an idea of currency strengths or weaknesses based on this. It's all supply / demand after all.

I know (and have personally seen) Tansen take 400-600+ pip swing trades after assessing this. That's not to say such trades come every day, often the setups can take a few weeks to even show up and a few weeks to play out.. not to mention getting a good entry without being prematurely stopped out is a craft in itself.. but using this analysis for longer term market trends can create some nice results.

One thing to keep note of: You're not just trading the US economy... a position in a currency pair also includes sentiment on the other side of the transaction.

For instance, a EURUSD trade will have as much to do with US sentiment as it does the Euro zone. Sure we can assume forces around the economic powerhouse that is the US will outweigh the Euro influence, but it is still the EURUSD exchange rate after all and what the ECB does will affect it greatly. So having your head wrapped around the current credit, interest rate, and yields found in the paired currency you are trading is an obvious must. You don't have to base your trade on them, and you can focus on the USD resources this thread talks about already, but don't ignore major rate decisions pending, or Euro bond auction results within the Euro zone if you're in a EURUSD position... they still matter.