Hello.

As you know, ICT has his public Inner Circle Trader youtube channel and he, also, sometimes uses either Twitter or Telegram. For this reason, I am not going to explain here the details, but to share a few charts that may serve as a visual aid. ICT is complex and no one can teach it to you, you need to experience it yourself. All the ideas shared by me are my own interpretation of trading and how I have also integrated ICT in my own trading style. These ideas do not reflect or try to explain what Michael Huddleston teaches, it is my own vision, and I strongly recommend anyone to first study the original ICT materials.

In this set, I am sharing only a few core ideas that, however, are enough for the aspiring trader, to experiment with and formulate a working strategy after proper trial-error backtesting.

There are four main topics, I think, should be the initial concern of the ICT student:

Being market maker models least important among all of them, it allows you to understand what the markets are doing.

Markets can be at a certain scale either consolidating or expanding. If you change your scale, the market phase will be different. It can be consolidating on H1 and expanding on W1 for instance. When you do not see any kind of structure in one timeframe, you will be able to find it on antoher timeframe. This is called markets fractality, and it means that if you do not see it, it is because it is happening anywher else you are not looking at.

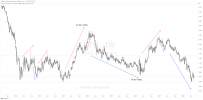

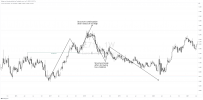

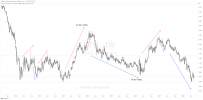

So, let's start by the least important, the market maker models. Two things may happen:

As you know, ICT has his public Inner Circle Trader youtube channel and he, also, sometimes uses either Twitter or Telegram. For this reason, I am not going to explain here the details, but to share a few charts that may serve as a visual aid. ICT is complex and no one can teach it to you, you need to experience it yourself. All the ideas shared by me are my own interpretation of trading and how I have also integrated ICT in my own trading style. These ideas do not reflect or try to explain what Michael Huddleston teaches, it is my own vision, and I strongly recommend anyone to first study the original ICT materials.

In this set, I am sharing only a few core ideas that, however, are enough for the aspiring trader, to experiment with and formulate a working strategy after proper trial-error backtesting.

There are four main topics, I think, should be the initial concern of the ICT student:

- Market maker models

- Market structure

- Orderflow

- Multi-timeframe analysis

Being market maker models least important among all of them, it allows you to understand what the markets are doing.

Markets can be at a certain scale either consolidating or expanding. If you change your scale, the market phase will be different. It can be consolidating on H1 and expanding on W1 for instance. When you do not see any kind of structure in one timeframe, you will be able to find it on antoher timeframe. This is called markets fractality, and it means that if you do not see it, it is because it is happening anywher else you are not looking at.

So, let's start by the least important, the market maker models. Two things may happen:

- Markets are buying -> prices are falling.

- Markets are selling -> prices are going up.