Ugg.. where to begin..

Firstly, and before anything else, I'm really glad you're both passionate about trading as a craft, as well as sure of your trading methods.

I's always good to see that in others.

AusDoc said:

Are you kidding Jack? Stop losses are not for losers. People who think they don't need stop losses are very interesting. I'm not that interesting, I always place stops.

I missed a word in the line you quoted of me, and you'll find it edited in the post itself from long ago. "I hope you're

NOT about to tell me..."

I've battled such people on the net for some time now, who harbor the idea that trading naked without a stop (or even a clue where they're wrong on a trade) is the best way to go. Often, these people will express a feeling that if they place a stop, they'll just get taken out by virtue of it being placed, and then subsequently watch as price moves in their intended direction afterward. I feel, as you put it yourself, their problem is a lack of precision with their entry... but I digress... I'm just glad you're not one of these people.

AusDoc said:

Yes, I understand the keeping it simple argument. I have no problem with that, just the unfortunate choice of phrase I've highlighted. I have seen this concept bandied around very widely for decades.

I do think you're reading too much into my material though... I'm mostly a scalper, so the example I gave was off the top of my 'tight stop, quick profit' mindset... I'm used to employing stops that are set tight enough that the first signs of "something's wrong" usually includes taking a small loss via said stop. No real room for manual stop management unless you're ultra fast and can read the noise of a few pips of oscillation can provide. So yes, I do stress the 'context' issue I brought up earlier. I'm going to get back to this thought later

**

For you, setting a disaster stop, but manually (and mentally) keeping your stop tight, works. However, that's just one way of slicing it, and there are many, many (profitable) methods of trading. If the "allow to get stopped out"' was a stop placed 5 pips in the red, what active management between 0 and -5 could the trader realistically expect to do? No where was my example advocating for a 30+pip stop and just watching it as the market chewed straight through such a wide range of price.. the stop distance was left out, because, again, it was just an illustrative example.

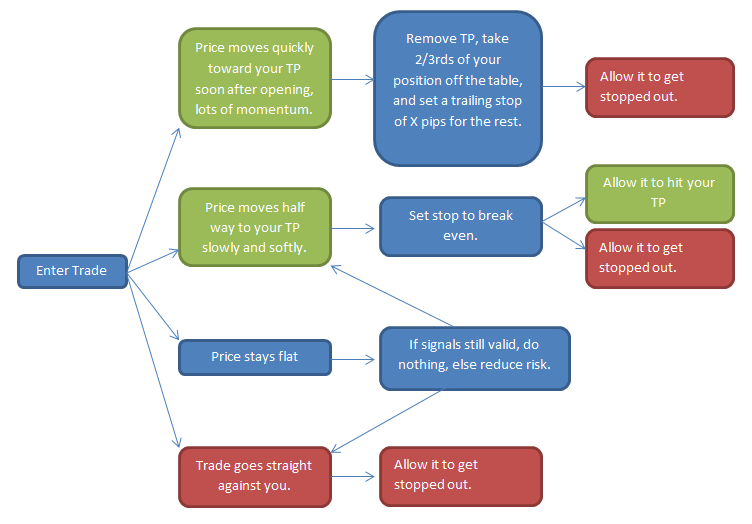

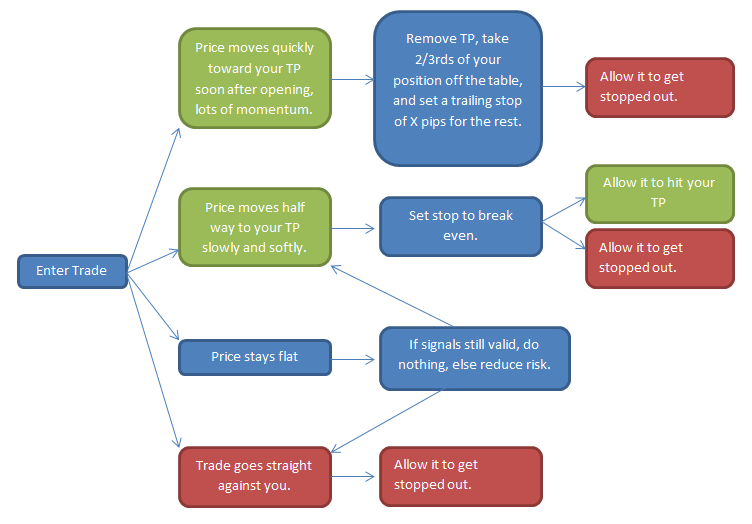

As the trader builds out such a decision tree process, they'd be filling in for more branches of possibilities based on their trading strategy and methods, and should they have a wide stop set, then there's a lot of room (and nothing stopping them--geddit? Stopping them? >.>) to work in tree branches that limit losses to less than the full initial stop amount.

AusDoc said:

You're absolutely right about using protection. I agree completely.

What I hate to see is new traders lapping up what they think is trading wisdom that is nothing more than old folly. I have heard traders bragging about their courage as they stood their ground and watched the market gradually turn against their position and move towards their stop. They talk tough about handling the stress and then shrugging the loss off while they look for their next entry.

Some, of course, tell it differently and lament the dreadful anxiety they experienced. They talk about their misery and look for comfort only to have self-professed more experienced traders tell war stories about the many times they have stood their ground and then just moved on. They drag out old favourites like "losses are just a part of the trading business" and "you have to get used to taking losses". Incredibly helpful stuff eh? Inspirational! What crap.

... ok, I get what you're trying to say, but before I dig into the details, I should point out that this thread series was not written to just rehash junk I once read in some failed trader's attempt to make money from selling books or courses. Everything I've written was based off my experiences trading prop and on my own for many years, it's what worked for me, or helped me get past plateaus in my own trading.

Yes, some of it reflects what others have already said (and at the beginning of the thread series, I state that I'm not reinventing the wheel here,) but if I've made mention of it in this thread series, it's because I've personally benefited from viewing the markets or my trading this way... and I refuse to push advice that I haven't vetted myself in my trading career.

That being said, there's a lot to be gained from learning how to take a loss in stride. No matter how good you are, you're going to have losses. Letting anxiety or emotions mix you up about them will only serve to hinder such things as discretionary trading.

This is NOT saying it's ok to just sit there and continually take losses without caring... this is about not letting losses break your ability (and mental fortitude) to follow your trading method and appropriate risk.

Your level of trading -- and do understand that many traders who are still striving for consistency are not trading with the discipline and experience your posts convey -- where an active risk management approach can yield a net benefit to your P/L, is not realistic to someone who still gets worked up and anxious over a trade that goes a bit south enough that they start violating their rules or mismanaging the trade.

Also, alleviating anxiety and emotional distress by seeking out others to tell them it's "ok" and 'losses are part of the game'... is not the reason why traders like myself advocate learning to shrug off losers. The idea is to mute the emotional side and be able to remain objective.. with that, the active management that you're talking can start to be a net benefit, but while the trader is consumed with emotions such active management might yield poor execution/risk decisions.

Again, I do feel you're reading into this material too much and filling in between the lines as if you're expecting to read the common dribble found around the net and in books that miss the mark on a trader's development.

AusDoc said:

When traders enter a position and then spend significant amounts of time in the red it just means they haven't learned how to trade with precision. For them success is going to be more about luck than skill. They have little choice but to accept their suffering or toughen up and develop good loser skills. Yes, let's be clear, that's what many traders spend time developing, loser skills. There are plenty of poor traders who are well qualified to teach these.

To some extent I agree and I think the market tends to teach bad habits every chance it can... but no where was my material suggesting it was ok to enter a trade and just sit in it, in the red, for long periods of time.. I didn't touch upon system development in this sense, and remarks like this is what keeps me asserting that you're reading too much into the material.

AusDoc said:

If you want to develop winner skills you must start with accepting responsibility. That means for the level and timing of your entries, your management of open positions and your decision to close and manner of doing so. If a trade goes against your position then you know immediately that you got something wrong. Hopefully not wrong enough to matter but the parameters matter and each individual trader needs to know exactly what they are for every trade and what actions should be taken in response.

Yes, personal responsibility is huge. I agree with this entire statement.

AusDoc said:

In my own trades I set stop losses at, in most cases, 20 or 30 pips. I do not worry too much about looking for levels to "hide" my stops behind and I don't care at all if it happens to align with a round number or any of the other equally feeble ideas floating around about "protecting" stops from the market. The stops only exist as emergency exits. I haven't had a full stop loss hit for many years.

On entry I fully anticipate that the market will move quickly in a profitable direction. If it doesn't it usually means I have made a poor entry. Sometimes it just means I need to be a tad more patient. If it moves five or so pips against me I become concerned and usually am out before it hits 10 pips. I will very quickly re-enter if I see that I was just a little bit out and the trade setup remains valid but I will not sit around stewing and hoping while it moves further against me. I certainly would never sit back and allow my position to get stopped out.

Traders need excellent decision-making skills and your simple decision tree is a useful tool for learning such skills. But traders need to remain fully engaged and very active while accepting full responsibility for their trading outcomes.

Ok, I suspected a bit, but now I'm more sure... you've written a prescription based on your own ailments, not the patient's.

You are right, if you anticipate the market will move quickly, and your resulting position just sits there slightly against you... something is wrong. Get out. But that's in the context of that specific style of trading (and that's actually exactly what I teach people when it comes to momentum trading in equities.)

My first manager at my the first firm I traded for used to say: "The market should just 'go!' If it sits there, almost telling you 'are you sure you don't want more shares? I'm about to run, you can buy more cheap now." ...then it's probably a bad trade. For momentum trading, I've held this idea close to heart and consistently find that it helps me keep out of trouble even to this day.

But all that being said, keeping a tight hard stop (say the -5-10 pip or less that you like to manually take yourself out at) and re-entering should the trade still be valid, isn't much different from how you manage it... it's just a bit more mechanical. I tend to advocate for removing the discretionary element of someone's trading should that person be stuck making impulsive and emotional execution choices.. after enough screen time and consistency/discipline is achieved, then a reintroduction of discretionary input based on objective experience can be applied for a net benefit. This is how I approach helping people, and it's how I developed myself when I struggled to get over "emo" trading while I was working to gain consistency when I first started out..

Re-read the introduction of this thread series if you have to, but the aim here isn't to teach people from the ground up, nor is it to direct already consistent and pro traders... my goal was to take someone who's spinning their wheels, force them to take a step back, work on discipline (directly and indirectly when it comes to trading) and then have them re-approach the market from a better reference point. It's still going to be up to them. I'm not teaching a method here. I just hope they might be in the right mindset after reading all this to give trading a fair shot, regardless of the trading method they take on. (I mean, really, the only specific things I speak out against, method wise, is not to average a loser simply to avoid a loss, and other loss aversion enablers.)

** Remember when I said I'd get back to an earlier thought at the end? Ok, here it is: I have homework for you!

I do not disagree with your ideas and sentiment, but I do feel you've jumped the gun a bit in judging this material. So instead of being all offended and defensive about it, I'd rather we be constructive. If you feel you could make a better moc-up example of a decision tree that includes your specific methods of active management, please create one and post it here. Don't forget to explain your reasons behind the logic statements on the chart.

This way other readers can benefit from seeing a more hands on and practical example from another source, as it might help them also create one of their own.

Sound good?