Gauer

Member

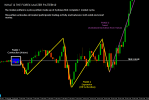

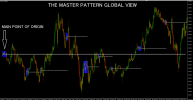

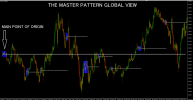

The Forex Master Pattern is an alternative form of technical analysis that provides a framework which helps you to find and follow the hidden price pattern that reveals the true intentions of financial markets. This mater pattern is formed by 3 phases, which complete 1 market cycle.

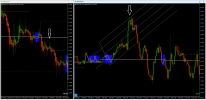

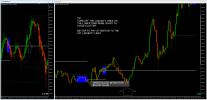

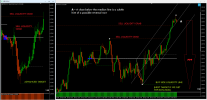

The Phase 1 is the contraction point (or Value). It is defined as simultaneous higher low and lower high.

On Phase 2 we get higher timeframe activation (also called Expansion), which is where price oscillates above and below the average price defined on Phase 1.

On Phase 3 is where we get a sustained deviation from value (the Trend).

How do you trade this?

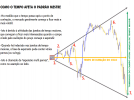

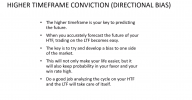

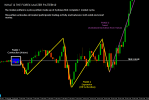

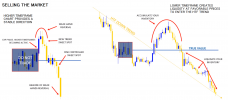

The basic strategy is very simple. Your higher timeframe provides a stable directional bias. It is important to have a good separation between HTF and LTF, for example 4H and 15M, 4H and 5M or 1H and 1M are good combos.

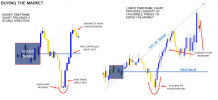

When your HTF is above value, you buy your LTF below value.

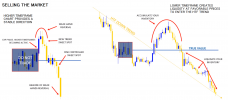

When your HTF is below value, you sell your LTF above value.

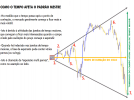

The Phase 1 is the contraction point (or Value). It is defined as simultaneous higher low and lower high.

On Phase 2 we get higher timeframe activation (also called Expansion), which is where price oscillates above and below the average price defined on Phase 1.

On Phase 3 is where we get a sustained deviation from value (the Trend).

How do you trade this?

The basic strategy is very simple. Your higher timeframe provides a stable directional bias. It is important to have a good separation between HTF and LTF, for example 4H and 15M, 4H and 5M or 1H and 1M are good combos.

When your HTF is above value, you buy your LTF below value.

When your HTF is below value, you sell your LTF above value.