You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

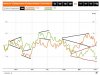

SMT Divergence - yields bonds futures

- Thread starter SLT

- Start date

Computater707

Well-Known Member

GdayFx said:following this 5 year yield chart, i can see divergence developing at a seasonal change

Thanks Gday. This helps me understand how to apply ICT inter market analysis and divergence.

Let me see if I can interpret the information:

1- The recent 5yr Pound index appears to be in a descending wedge, which is a reversal pattern so I would expect that dollar and pound interest rates may become convergent like they were from about mid October 2013 to late June of 2014.

2- I attached a weekly chart of GBPUSD that highlights that period. Note that the blue lines are 100pip round numbers. The fib and previous S/R areas indicate that a reversal or consolidation may begin soon.

3- Therefore the end of the current GBPUSD down trend may be near. Consolidation or reversal is to be expected in the next few weeks. I should reduce risk per trade and look for reversal patterns

Is this correct?

Attachments

Computater707 said:Thanks Gday. This helps me understand how to apply ICT inter market analysis and divergence.

Let me see if I can interpret the information:

1- The recent 5yr Pound index appears to be in a descending wedge, which is a reversal pattern so I would expect that dollar and pound interest rates may become convergent like they were from about mid October 2013 to late June of 2014.

2- I attached a weekly chart of GBPUSD that highlights that period. Note that the blue lines are 100pip round numbers. The fib and previous S/R areas indicate that a reversal or consolidation may begin soon.

3- Therefore the end of the current GBPUSD down trend may be near. Consolidation or reversal is to be expected in the next few weeks. I should reduce risk per trade and look for reversal patterns

Is this correct?

reducing risk at current levels, yes

i definitely will be watching for reversal patterns, though at the same time staying nimble also looking for shorts