You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ICT Homework Thread May 18th - 23rd, 2014

- Thread starter Tansen

- Start date

- Status

- Not open for further replies.

Hopiplaka

My thanks go out to ICT - the life changer

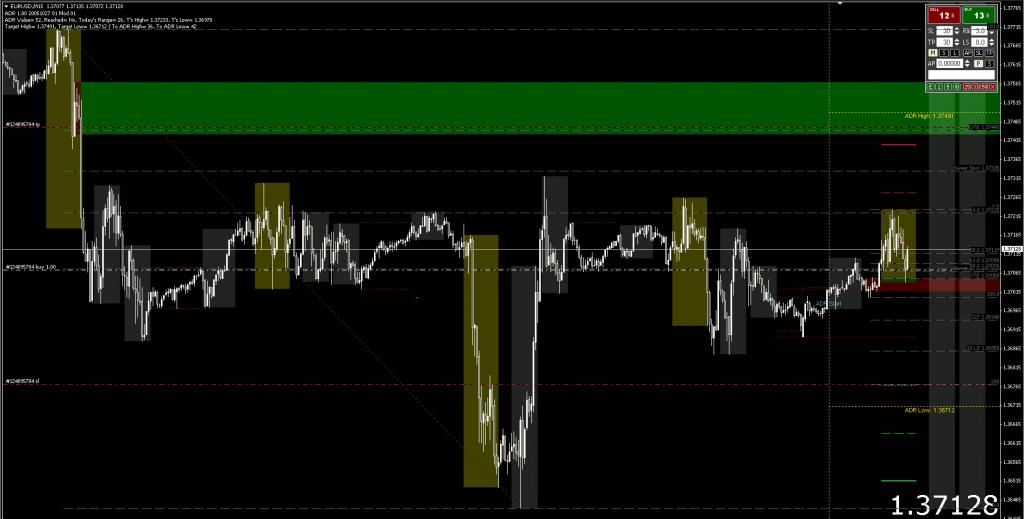

I'm a buyer of GU @ 1.6760 region:

[list type=decimal]

[*]break 1, break 2 seen

[*]4H MS bullish

[*]15 MIN order block

[*]STD3 BUY Zone

[*]OTE Zone

[*]Reflection pattern from Friday's low to high

[/list]

I'll watch LO with great interest tomorrow

[list type=decimal]

[*]break 1, break 2 seen

[*]4H MS bullish

[*]15 MIN order block

[*]STD3 BUY Zone

[*]OTE Zone

[*]Reflection pattern from Friday's low to high

[/list]

I'll watch LO with great interest tomorrow

Attachments

Day 16 USDJPY. This should run down for most of the day, so there's a double issue for the trader on this. The first is that there's likely a Short for 20-30 pips available today. It really depends on how the Asian Session shows out.

Then there's a likely Weekly Swing Low to form. Though I would not be surprised if the "true low" was last Thursday. Though a Run down to 1.5 STD of the CDR could be a great place to get in. 101.20 to 101.25 is the Key Area. If it flies through that, we could be in for a while week.

Then there's a likely Weekly Swing Low to form. Though I would not be surprised if the "true low" was last Thursday. Though a Run down to 1.5 STD of the CDR could be a great place to get in. 101.20 to 101.25 is the Key Area. If it flies through that, we could be in for a while week.

Attachments

syzygus009

Well-Known Member

Hopiplaka

My thanks go out to ICT - the life changer

Sqa,sqa said:Day 16 USDJPY. This should run down for most of the day, so there's a double issue for the trader on this. The first is that there's likely a Short for 20-30 pips available today. It really depends on how the Asian Session shows out.

Then there's a likely Weekly Swing Low to form. Though I would not be surprised if the "true low" was last Thursday. Though a Run down to 1.5 STD of the CDR could be a great place to get in. 101.20 to 101.25 is the Key Area. If it flies through that, we could be in for a while week.

I missed the recent webinars, but is 1,5 STD an important zone?

Hopiplaka

My thanks go out to ICT - the life changer

It seems like the dealer range midpoint levels are also useful for dynamic S/R lines, so I added an option to my indicator to display the midpoint levels.sqa said:Specifically 1.5 CDR I don't think has been mentioned by ICT, but it's a pretty good zone to move to before a reversal, however. Though if the major level was under 1 CDR, I'd probably be looking for it to slam through it.

If you missed the real low of the day, you can enter on these levels with greater reassurance

Attachments

syzygus009

Well-Known Member

saeedzaman

Well-Known Member

saeedzaman

Well-Known Member

saeedzaman

Well-Known Member

kate682

Well-Known Member

Hopiplaka said:I'm a buyer of GU @ 1.6760 region:

[list type=decimal]

[*]break 1, break 2 seen

[*]4H MS bullish

[*]15 MIN order block

[*]STD3 BUY Zone

[*]OTE Zone

[*]Reflection pattern from Friday's low to high

[/list]

I'll watch LO with great interest tomorrow

Hi Hopiplaka

Like your charts, if you don't mind, can you tell me what fib is your KILL, i like that, its permanent. I still fight my stop loss gremlims

Hugs Kate

x

Hopiplaka

My thanks go out to ICT - the life changer

Hi Kate,kate682 said:Hi Hopiplaka

Like your charts, if you don't mind, can you tell me what fib is your KILL, i like that, its permanent. I still fight my stop loss gremlims

Hugs Kate

x

It's the 90% fib level. ICT mentioned it in one of his video's a couple of years ago.

With the recent order block info where ICT said that the 50% level of the order block should be respected, it seems to align with it as well.

It's not a hard stop but certainly puts me on alert

saeedzaman

Well-Known Member

Day 17! A little late on this one, as I looked at the chart around 2200 GMT, but I forgot to do this work up before I got some sleep. Though it doesn't really matter too much, as a 23 pip CDR screams Z-day going into the news Cycle Today & Tomorrow. (Japanese Rate decision minutes + Speech, followed by FOMC minutes 15 hours later.) They're setting traps and will likely clean out everyone before starting the next move. Thus, we wait on hints.

Not that there probably isn't 30 pips to carve out each direction today.

Not that there probably isn't 30 pips to carve out each direction today.

Attachments

kate682

Well-Known Member

sqa said:Day 17! A little late on this one, as I looked at the chart around 2200 GMT, but I forgot to do this work up before I got some sleep. Though it doesn't really matter too much, as a 23 pip CDR screams Z-day going into the news Cycle Today & Tomorrow. (Japanese Rate decision minutes + Speech, followed by FOMC minutes 15 hours later.) They're setting traps and will likely clean out everyone before starting the next move. Thus, we wait on hints.

Not that there probably isn't 30 pips to carve out each direction today.

Hi Sqa, I think i missed the webinar on z-days. Do you possibly know which one it was?

Or a brief explanation if/when you have the time.

Thank you.

And also a belated thanks for doing your precis of the ict's webinars, i find these invaluable, much like the old revision guides.

Hugs Kate

xx

- Status

- Not open for further replies.